Highlights:

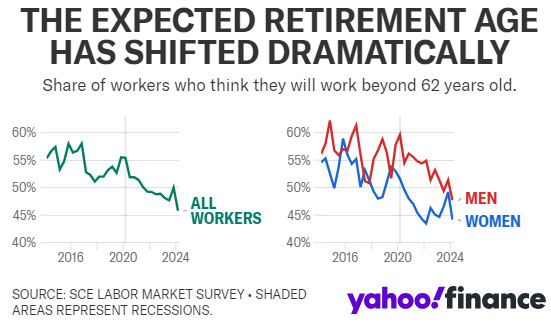

- Workers expecting to work beyond age 62 decreased to 45.8% in March, down from 55.4% four years ago.

- Those expecting to work beyond 67 also declined to 31.2%, down from 36.2% four years ago.

- Factors influencing these changes include preferences for part-time work, economic confidence, and concerns about future financial security.

Most Americans Don’t Expect to Work into Their Mid-60s: Chart of the Week

New data from the New York Fed reveals a significant shift in Americans’ retirement expectations. The survey shows that the number of workers expecting to work beyond age 62 has plummeted to 45.8% in March, down from 55.4% four years ago. Similarly, the percentage of workers expecting to work beyond 67 has decreased to 31.2%, down from 36.2% four years ago.

Changing Retirement Expectations

The decline in retirement age expectations was noted across various demographics, including age, education, and income levels. New York Fed economists cite several factors influencing these changing expectations, including preferences for part-time or freelance work, economic confidence, and concerns about future financial security.

The shift in retirement age expectations is especially pronounced among women. Factors such as caregiving responsibilities, wage disparities, and longer life expectancies may contribute to women’s inclination to retire earlier.

Implications for the Future Workforce

This shift in retirement expectations could have significant implications for the future workforce, particularly in light of potential paradigm shifts brought on by AI and automation. The uncertainty surrounding future work trends, including the possibility of a 10-hour work week, adds complexity to retirement planning for many individuals.

Conclusion

The changing expectations around retirement age underscore the evolving nature of work and retirement in the United States. As the workforce continues to evolve, careful consideration of financial futures and retirement planning is more critical than ever.

Understanding the factors driving these changes is essential for policymakers and individuals alike as they navigate retirement planning and future workforce trends.

Leah Hendricks is a Senior Editor at VOU (voiceofusa.com) Finance, running newsletters. Follow her on Twitter @iam_leahhen.

Here are some resources for further information:

- Yahoo Finance: finance.yahoo.com/americans-dont-expect-to-work

- Federal Reserve Bank of New York: newyorkfed.org/post-pandemic-shift

More on VOU

The Persistence of Unhealthy Diets in the United States: An Examination

Highlights The State of American Diets Recent research from Tufts University, published in the Annals of…

Here’s Why Refined Sugar is a Slow Poison According to Nutritionists

Highlights White sugar, also known as refined sugar, is a staple in many diets worldwide. While…

ByteDance Teams Up with Broadcom and TSMC to Develop 5nm AI Chip

Highlights: ByteDance’s Strategic Move in AI Chip Development TikTok’s parent company, ByteDance, has embarked on a…

Apple and Meta Eyeing AI Partnership

Highlights Apple and Meta’s AI Vision Apple is reportedly in talks with Meta to explore a…